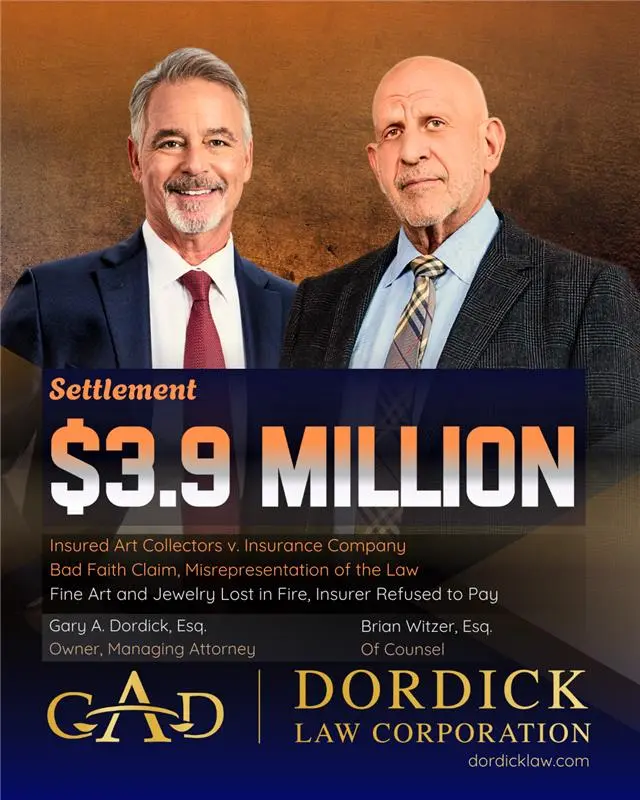

Our clients suffered the total loss of their insured fine art and jewelry collection when their home was destroyed by fire. For years, the referring attorney had been unable to secure any compensation from the insurance company. Despite the clients maintaining current payments on two policies, the insurer repeatedly denied their claims, citing vague and inconsistent reasons. The company issued hundreds of unreasonable documentation requests, often repeating them even after the requested information had already been provided or was irrelevant to the valuation of the items. At one point, the insurer wrongly claimed that the statute of limitations had expired, contradicting the law, which clearly states that the statute of limitations does not begin until a claim has been formally denied.

Once our firm took over the case, we meticulously reviewed extensive photographic evidence and documentation related to the insured items. We then notified the insurer of our intention to pursue a bad faith claim due to their delays and misrepresentation of the law. Within weeks of demanding full policy limits for both scheduled and unscheduled items, the insurer fully tendered the amount of $3.9 million, resulting in a successful settlement for our clients.